sheridany

RVF Supporter

Cathie Woods is a respected fund manager and she believes the used car market is going tumble. Will that happen in RV’s?

www.marketwatch.com

www.marketwatch.com

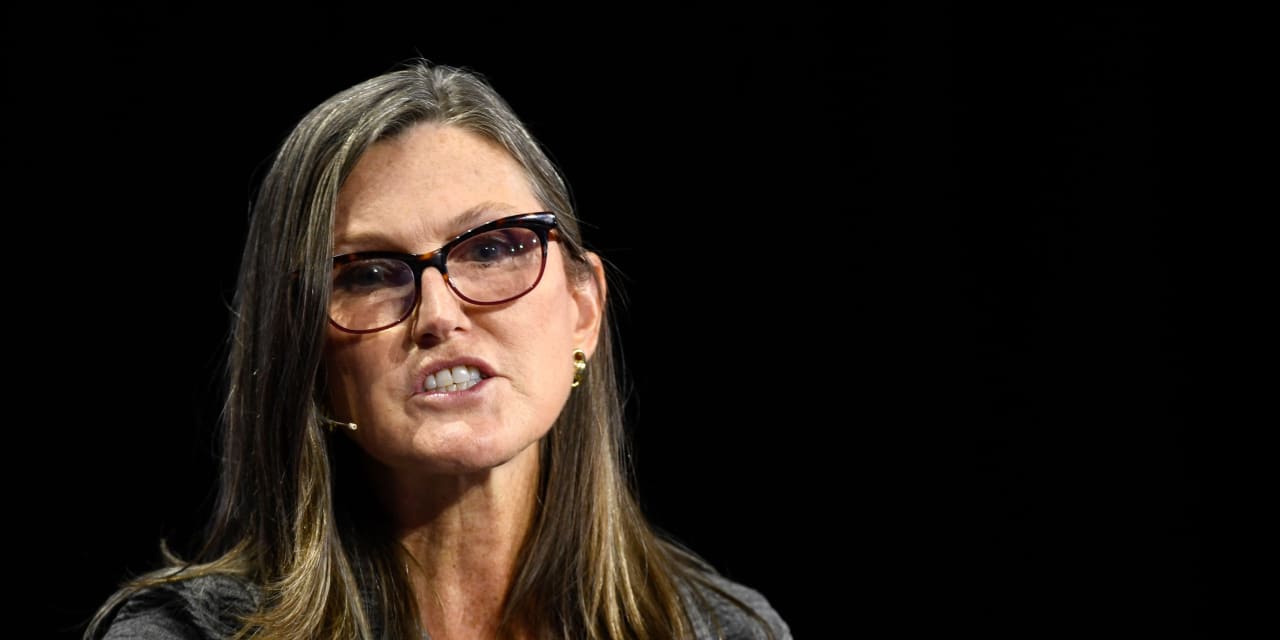

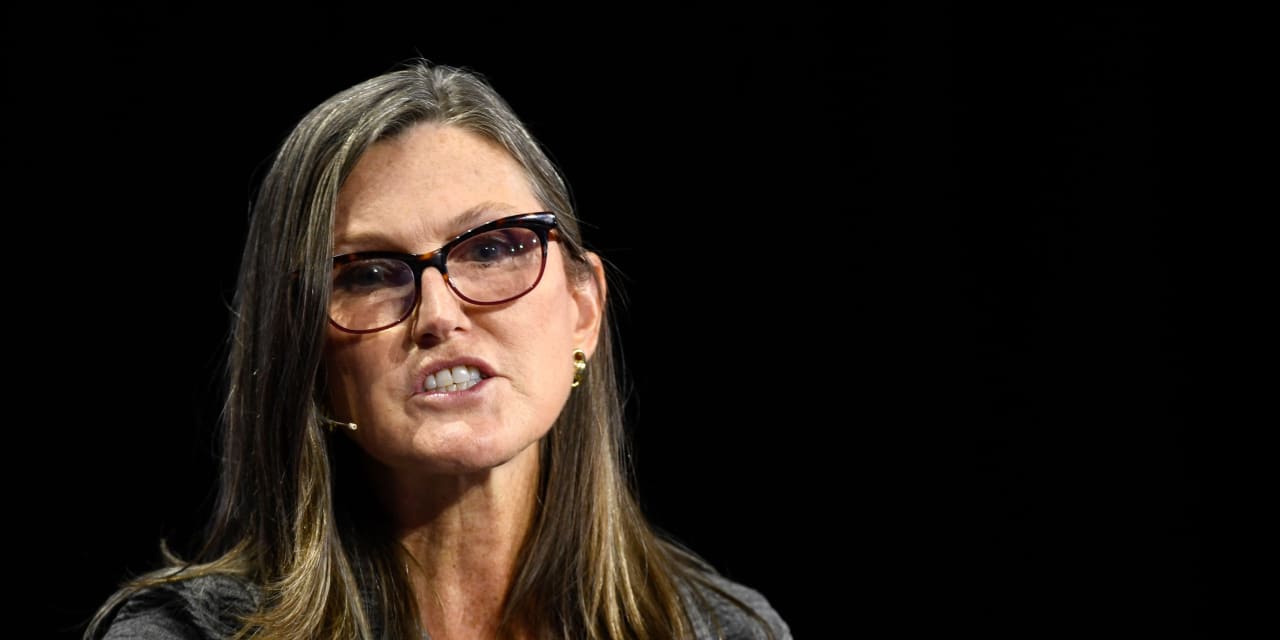

Cathie Wood is expecting a 'bloodbath' in this segment of the market: 'autos are one example of…many disturbances out there in the world order'

Cathie Wood, the star fund manager and chief executive of ARK Invest, in a Tuesday monthly market update says that the used car market is where she is...