Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

Welcome to RVForums.com

- Register now and join the discussion

- Friendliest RV Community on the web

- Modern site for PC's, Phones, Tablets - no 3rd party apps required

- Ask questions, help others, review campgrounds

- Get the most out of the RV Lifestyle

- Invite everyone to RVForums.com and let's have fun

- Commercial/Vendors welcome

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Question How to register in Montana?

- Thread starter slombo

- Start date

scottramer

RVF VIP

- Joined

- Dec 20, 2020

- Messages

- 108

- RV Year

- 2019

- RV Make

- Newmar

- RV Model

- London Aire 4543

- RV Length

- 44'10"

- Chassis

- Freightliner

- Engine

- X15 605 HP

- TOW/TOAD

- 2023 Jeep Grand Cherokee Summit Reserve and 2021 Ram 1500 Pick Up

- Fulltimer

- No

- Joined

- Nov 2, 2019

- Messages

- 1,161

- Location

- Fulltiming

- RV Year

- 2022

- RV Make

- Newmar

- RV Model

- London Aire 4551

- RV Length

- 45

- TOW/TOAD

- Yukon Denali

- Fulltimer

- Yes

Contact Bennett Law Office. They can help you. They will first provide you with a copy of the relevant portion of the statute of the state you are domiciled. Once you read that, you can then decide whether you want to go forward.

Joe Hogan

RVF Supporter

- Joined

- Nov 3, 2019

- Messages

- 2,851

- Location

- Florida

- RV Year

- 2024

- RV Make

- Newmar

- RV Model

- Dutch Star 4311

- RV Length

- 43

- Chassis

- Spartan

- Engine

- Cummins

- TOW/TOAD

- 2018 Ford Flex

- Fulltimer

- No

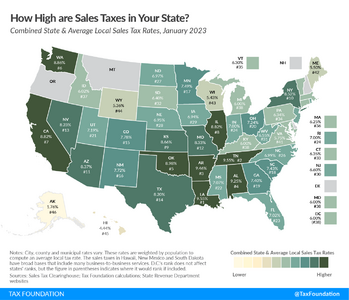

BTW, cities like Chicago are wise to this tax dodge and will pull you over to see if your license a Montana, if not why not, etc. if not, expect a ticket or worse.

andersonadvisors.com

andersonadvisors.com

jalopnik.com

jalopnik.com

Should I Register My Vehicle in Montana?

Learn if it's a wise decision to register your vehicle in Montana. While there are a few benefits, they do not outweigh the downside. Get details here.

The Pitfalls Of The Montana License Plate Scam

I get asked from time to time about the so-called Montana License Plate Scam: Can you safely register your vehicle in Montana and drive it in your non-Montana home state? There are a couple problems which might crop up if you give it a try.

jalopnik.com

jalopnik.com

Jireh Financial

Commercial Member

- Joined

- Feb 25, 2021

- Messages

- 401

- Location

- Michigan

- RV Year

- 2019

- RV Make

- Holiday Rambler

- RV Model

- Vacationer 35K

- RV Length

- 36

- Fulltimer

- No

States don't like missing out on the sales tax, registrations and title fees. We have done a couple finance deals when the seller has the MT LLC. One was completed and one fell through. The state of the new buyer has had questions about why the paperwork does not match up with the seller info. Just my opinion but if you need an attorney to help with a purchase, there is something wrong.

Let us know how we can help.

Ken

Let us know how we can help.

Ken

Kevin D Pem

RVF 1K Club

- Joined

- Jul 29, 2020

- Messages

- 4,044

- Location

- AZ

- RV Year

- 1984

- RV Make

- Alpinelite

- RV Length

- 26'

- TOW/TOAD

- 2016 Ram 1500

- Fulltimer

- Yes

Been leaving this alone but!

I agree with much of what Is printed above!

I am not fond of LLCs. I get why some go that route, but they do create hoops on the other side of the journey.

I know how the forest service views those talking advantage of the loop hole, because I volunteered and in talking to the supervisor I was told.

It's simple! I love my state (az) !! I don't love the tax structure, but at the end of the day, I keep everything above board! It's just simpler that way. I don't really have a domicile and use an address In Yuma. I could use any state to register my stuff, but alas, Arizona gets most of my business, so the state gets my money as well.

I agree with much of what Is printed above!

I am not fond of LLCs. I get why some go that route, but they do create hoops on the other side of the journey.

I know how the forest service views those talking advantage of the loop hole, because I volunteered and in talking to the supervisor I was told.

It's simple! I love my state (az) !! I don't love the tax structure, but at the end of the day, I keep everything above board! It's just simpler that way. I don't really have a domicile and use an address In Yuma. I could use any state to register my stuff, but alas, Arizona gets most of my business, so the state gets my money as well.

Joe Hogan

RVF Supporter

- Joined

- Nov 3, 2019

- Messages

- 2,851

- Location

- Florida

- RV Year

- 2024

- RV Make

- Newmar

- RV Model

- Dutch Star 4311

- RV Length

- 43

- Chassis

- Spartan

- Engine

- Cummins

- TOW/TOAD

- 2018 Ford Flex

- Fulltimer

- No

Beside the ethical tax issues, if you have ever had to deal with State Sales Tax authorities, which I have as a Professional Accountant (earlier career), and a business owner, these folks are very sensitive to being denied the state's piece of your transactions.

It gets ugly, and expensive very quickly if you get on the wrong side of them.

Early in my auditor/accounting career I had the opportunity to attempt restore "in good standing" to a few NYC wantabe 'wiseguy' sales tax problems.

It is unpleasant, very time intensive and expensive.

It gets ugly, and expensive very quickly if you get on the wrong side of them.

Early in my auditor/accounting career I had the opportunity to attempt restore "in good standing" to a few NYC wantabe 'wiseguy' sales tax problems.

It is unpleasant, very time intensive and expensive.

- Joined

- Nov 2, 2019

- Messages

- 1,161

- Location

- Fulltiming

- RV Year

- 2022

- RV Make

- Newmar

- RV Model

- London Aire 4551

- RV Length

- 45

- TOW/TOAD

- Yukon Denali

- Fulltimer

- Yes

This is simply incorrect and bad information. If you are a fulltimer, you can absolutely utilize a MT LLC as long as you understand the statues in the state you are domiciled in. For instance, if you are domiciled in Florida, you will have to wait 6 months before you can enter the state with your rig that is registered in MT. You may even at that time want to reregister your rig in your domiciled state. Using an attorney is to insure that the LLC is formed correctly just as if you were to use an attorney in any transaction. It does not mean "something is wrong."if you need an attorney to help with a purchase, there is something wrong.

There is a huge difference between tax avoidance and tax evasion. If, however, you are domiciled in a state for which you own property and reside, then YES, you are taking a risk. States like Colorado and others look for Montana tags and it may take 2 years, but they will collect their sales tax, penalties and more from you.

Similar threads

- Replies

- 2

- Views

- 728

- Replies

- 16

- Views

- 646

Latest resources

-

Trueline Leveling System (Valid Air)Operation & Service Manuals for the Valid Air leveling system

- Jim

- Updated:

-

-

Notes on the Electrical Systems of the Roadtrek Zion Family of RVsNotes on the Electrical Systems of the Roadtrek Zion Family of RVs

- dilbertjth

- Updated:

-

-